Hedge Fund Insights: Why Market Timing and Valuations Don't Align

MarketWatch Top Stories

•

•

3 min read

•

Intermediate

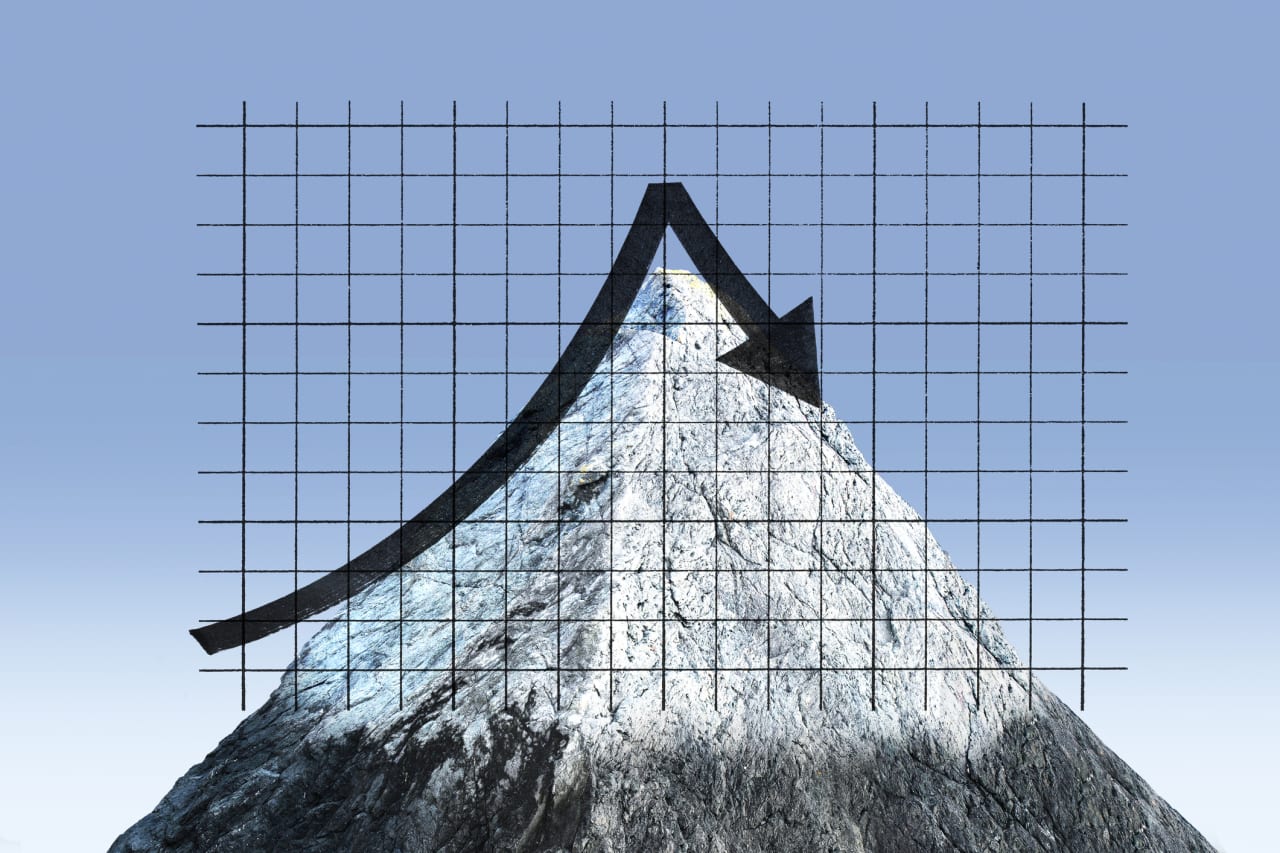

In its November newsletter, a leading hedge fund has provided crucial insights into the current state of the U.S. financial markets. Despite the widespread consensus that U.S. stock valuations are significantly elevated, the hedge fund emphasizes that these valuations are not reliable indicators for predicting market movements. This assertion challenges the traditional approach to market timing, which often relies on valuation metrics to dictate investment strategies. The hedge fund's analysis suggests that while high valuations may indicate a potential risk for future market corrections, they do not necessarily forecast when these corrections will occur. As investors grapple with the complexities of the current economic landscape, this perspective serves as a reminder that market timing strategies based on valuations can lead to missed opportunities or misjudgments. Instead of relying solely on valuation metrics, the hedge fund advocates for a more holistic approach to investing that considers a variety of factors, including economic indicators, market sentiment, and global events. This shift in perspective could encourage investors to remain engaged in the market rather than retreating based on valuation concerns alone. As the financial landscape evolves, understanding the nuances of market behavior becomes increasingly essential for all investors, whether they are seasoned professionals or newcomers to the market.